General Instructions and Disclaimers

Use of Templates. It is essential that, prior to adopting this Fair Credit Policy and Fair Credit Compliance Program, dealers read the templates carefully, make adjustments that are appropriate to their individual circumstances, and ensure that the final policy and program they adopt are reviewed by qualified counsel. While italicized language that appears in brackets identifies areas of the document where an individualized dealer entry is appropriate, dealers should modify both italicized and non-italicized portions of the document that they and their counsel determine is necessary.

Program Scope. The Fair Credit Compliance Program is broader than a pure dealer participation pricing policy that is designed to help mitigate a finding of disparate impact discrimination under ECOA and Regulation B. This is because, as explained above, ECOA and Regulation B prohibit intentional discrimination and (in the view of federal regulators) disparate impact discrimination, and it is therefore essential that fair credit training programs address both prohibitions. However, the Program does not attempt to address every issue that potentially relates to fair credit compliance at a franchised automobile dealership (e.g., how the dealership handles oral requests for financing, desking procedures, conditional sales agreements, and the sale of products to protect the customer’s investment in the financed vehicle). These issues are very dealer specific and need to be addressed in a manner that is appropriate to the dealership’s circumstances. For these reasons, the Program template should be viewed as part of a broader dealership effort to develop a comprehensive approach to fair credit compliance.

Program Approval. Neither ECOA nor Regulation B require creditors to adopt a written fair credit program or, if they adopt such a program, to have it approved by any particular body or individual officer within their business.12 However, for the reasons stated above, it is prudent for creditors to do so. The Program template assumes that a board of directors will adopt the dealership’s Fair Credit Compliance Program, appoint a Program Coordinator to administer the Program, receive compliance reports from the Program Coordinator, and amend the Program as necessary to address fair credit risks that are present at the dealership. If the dealership’s governing structure dictates that another dealership body or officer should exercise these functions, the template should be modified accordingly. Regardless of which dealership body or officer acts in this manner, it is important that its leadership affirmatively establish and express support for its fair credit commitment.

Program Limitations. The Program’s approach to determining the compensation dealers receive for arranging financing for customers is not, and the Program template has not been, mandated by ECOA or Regulation B and neither have been formally adopted by any federal agency as a means of satisfying the requirements of federal law. Nor is there any guarantee that adopting the attached Program or any component of it will adequately protect a dealership from a governmental enforcement action or private lawsuit.13 Notwithstanding these limitations, NADA believes the Program template represents a solid attempt to promote compliance with ECOA and Regulation B while preserving enough flexibility to allow customers to continue leveraging the overwhelming benefits that are produced by today’s intensely competitive vehicle financing market.

It is essential that dealers read the caveats and disclaimers contained within these documents and consult with their counsel when making decisions related to fair credit compliance.

Implementation Steps in this Guide

-

Review the Overview of Fair Credit Compliance Policy & Program Templates Document

-

Review the NADA Fair Credit Compliance Policy & Program Booklet Document

-

Edit and Distribute the Fair Credit Reporting Act Policy for Auto Dealers (NADA)

-

Edit and Distribute the Appendix A: [Name of Dealership] Fair Credit Policy

-

Edit and Distribute the Appendix B: [Name of Dealership] Standard Dealer Participation Rate Policy

-

Edit and Distribute the Appendix C: [Name of Dealership] Inventory Reduction Criteria Form

-

Schedule the Appendix D: Dealer Participation Certification Form for Distribution

-

Schedule the Appointment and Policy & Program Approval Form for Distribution

Review the Overview of Fair Credit Compliance Policy & Program Templates Document

- Click on the Library tab

- Search for "Proper Completion of the 553 Retail Install Sales Contract Document" and click on it

- Review the document

Review the NADA Fair Credit Compliance Policy & Program Booklet Document

- Click on the Library tab

- Search for "Proper Completion of the 553 Retail Install Sales Contract Document" and click on it

- Click on the filename to download and review it

Edit and Distribute the Fair Credit Reporting Act Policy for Auto Dealers (NADA)

Edit the policy

- Click on the Library tab

- Search for "Fair Credit Reporting Act Policy for Auto Dealers (NADA)" and click on it

- Click on the Edit button to view the list of versions

- Click Create Draft to the right of the latest published version

- Click Edit next to the Draft version that you just created

- Make desired changes to the policy

- Click Publish when you have finished editing the policy

- Click on the Permissions subtab

- Add the appropriate group(s) of users who have permission to view this policy within the library

- Click Submit to save

Schedule the activity for distribution

- Click on the Workspaces tab

- Click on the Consumer Finance workspace

- Click on the NADA Fair Credit Compliance initiative

- Click on the Fair Credit Reporting Act Policy for Auto Dealers (NADA)

- Click on Groups and assign to the appropriate groups, such as All Employeest.

- Click on Schedule and set an annual schedule based on the Hire Date. We recommend that you set the Immediate Distribution option to Yes.

- Click Save

Edit and Distribute the Appendix A: [Name of Dealership] Fair Credit Policy

Edit the policy

- Click on the Library tab

- Search for "Appendix A: [Name of Dealership] Fair Credit Policy" and click on it

- Click on the Edit button to view the list of versions

- Click on the Edit button again to edit the title of the policy. Replace [Name of Dealership] with the name of your dealership or auto group.

- Click Save.

- Click Create Draft to the right of the latest published version

- Click Edit next to the Draft version that you just created

- Make desired changes to the policy

- Click Publish when you have finished editing the policy

- Click on the Permissions subtab

- Add the appropriate group(s) of users who have permission to view this policy within the library

- Click Submit to save

Schedule the activity for distribution

- Click on the Workspaces tab

- Click on the Consumer Finance workspace

- Click on the NADA Fair Credit Compliance initiative

- Click on the Appendix A: [Name of Dealership] Fair Credit Policy

- Click on Groups and assign to the appropriate groups, such as All Employeest.

- Click on Schedule and set an annual schedule based on the Hire Date. We recommend that you set the Immediate Distribution option to Yes.

- Click Save

Edit and Distribute the Appendix B: [Name of Dealership] Standard Dealer Participation Rate Policy

Edit the policy

- Click on the Library tab

- Search for "Appendix A: [Name of Dealership] Fair Credit Policy" and click on it

- Click on the Edit button to view the list of versions

- Click on the Edit button again to edit the title of the policy. Replace [Name of Dealership] with the name of your dealership or auto group.

- Click Save.

- Click Create Draft to the right of the latest published version

- Click Edit next to the Draft version that you just created

- Make desired changes to the policy

- Click Publish when you have finished editing the policy

- Click on the Permissions subtab

- Add the appropriate group(s) of users who have permission to view this policy within the library

- Click Submit to save

Schedule the activity for distribution

- Click on the Workspaces tab

- Click on the Consumer Finance workspace

- Click on the NADA Fair Credit Compliance initiative

- Click on the Appendix A: [Name of Dealership] Fair Credit Policy

- Click on Groups and assign to the appropriate groups, such as All Employeest.

- Click on Schedule and set an annual schedule based on the Hire Date. We recommend that you set the Immediate Distribution option to Yes.

- Click Save

Edit and Distribute the Appendix C: [Name of Dealership] Inventory Reduction Criteria Form

Edit the policy

- Click on the Library tab

- Search for "Appendix C: [Name of Dealership] Inventory Reduction Criteria Form" and click on it

- Click on the Edit button to view the list of versions

- Click on the Edit button again to edit the title of the policy. Replace [Name of Dealership] with the name of your dealership or auto group.

- Click Save.

- Click Create Draft to the right of the latest published version

- Click Edit next to the Draft version that you just created

- Make desired changes to the policy

- Click Publish when you have finished editing the policy

- Click on the Permissions subtab

- Add the appropriate group(s) of users who have permission to view this policy within the library

- Click Submit to save

Schedule the activity for distribution

- Click on the Workspaces tab

- Click on the Consumer Finance workspace

- Click on the NADA Fair Credit Compliance initiative

- Click on the Appendix C: [Name of Dealership] Inventory Reduction Criteria Form

- Click on Groups and assign to the appropriate groups, such as All Employeest.

- Click on Schedule and set an annual schedule based on the Hire Date. We recommend that you set the Immediate Distribution option to Yes.

- Click Save

Schedule the Appendix D: Dealer Participation Certification Form for Distribution

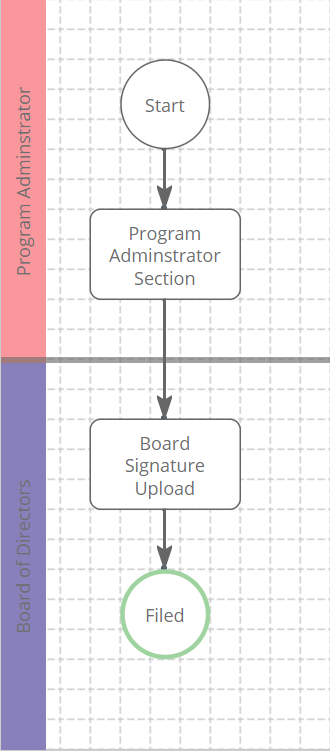

Review the Process Workflow

Set the form routing

- Click on the Admin tab

- Click on Workflow/Forms subtab

- Click on Processes

- Search for and click on Appendix D: Dealer Participation Certification Form

- Edit the routing rules for each stage by following these suggestions:

Stage Suggested Routing Rule Description Program Administrator Section Subject Route to the "Subject" (i.e. the person to whom the system sent this form) Board Signature Upload Queue Route either to a queue that contains an Administrator who will upload the signed document

Schedule the Activity for distribution

- Click on the Workspaces tab

- Click on the Consumer Finance workspace

- Click on the NADA Fair Credit Compliance initiative

- Click on the Appendix D: Dealer Participation Certification Form

- Click on Groups and assign to the appropriate group(s), which should be a group that only contains your Program Administrator

- Click on Schedule and set the appropriate schedule. We suggest a one-time schedule due immediately.

- Click Save

Schedule the Appointment and Policy & Program Approval Form for Distribution

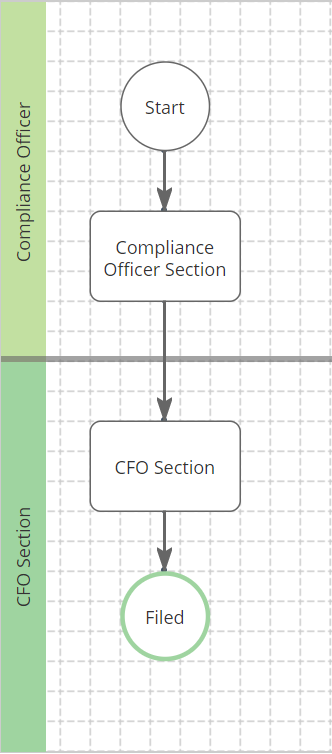

Review the Process Workflow

Set the form routing

- Click on the Admin tab

- Click on Workflow/Forms subtab

- Click on Processes

- Search for and click on Appointment and Policy & Program Approval Form

- Edit the routing rules for each stage by following these suggestions:

Stage Suggested Routing Rule Description Compliance Officer Section Subject Route to the "Subject" (i.e. the person to whom the system sent this form) CFO Section Queue Route to a queue that contains your CFO

Schedule the Activity for distribution

- Click on the Workspaces tab

- Click on the Consumer Finance workspace

- Click on the NADA Fair Credit Compliance initiative

- Click on the Appointment and Policy & Program Approval Form

- Click on Groups and assign to the appropriate group(s), which should be a group that only contains your Compliance Officer

- Click on Schedule and set the appropriate schedule. We suggest a one-time schedule due immediately.

- Click Save

Comments

0 comments

Please sign in to leave a comment.