Like many businesses, dealerships are subject to anti-money laundering laws. Participating in a money laundering scheme can result in heavy civil and criminal penalties and even prison for the individual and the dealership owner. This program is intended to steer employees away from this type of activity and train appropriate staff on how to recognize if money laundering might be occurring within the company.

Implementation Steps in this Guide

-

Edit and Distribute the IRS Form 8300 Cash Reporting Rule Policy

-

Schedule the Cash Reporting Certification Form for Distribution

-

Allow Employees to Start the Suspected Misconduct Report Form

Edit and Distribute the IRS Form 8300 Cash Reporting Rule Policy

Edit the policy

- Click on the Library tab

- Search for "IRS Form 8300 Cash Reporting Rule Policy" and click on it

- Click on the Edit button to view the list of versions

- Click Create Draft to the right of the latest published version

- Click Edit next to the Draft version that you just created

- Make desired changes to the policy

- Click Publish when you have finished editing the policy

Schedule the activity for distribution

- Click on the Workspaces tab

- Click on the Consumer Finance workspace

- Click on the Money Laundering initiative

- Click on the IRS Form 8300 Cash Reporting Rule Policy

- Click on Groups and assign to the appropriate groups, such as management, controller, sales, finance and insurance, cashiers, and anyone who participates in a cash transaction or files a form 8300 form.

- Click on Schedule and set an annual schedule based on the Hire Date. We recommend that you set the Immediate Distribution option to Yes.

- Click Save

Review, Edit and Assign the Cash Reporting Guideline

- Click on the Library tab

- Search for "Cash Reporting Guideline" and click on it

- Click on the Edit button to view the list of versions

- Click Create Draft to the right of the latest published version

- Click Edit next to the Draft version that you just created

- Make desired changes to the policy

- Click Publish when you have finished editing the policy

- Click on Permissions and set which groups can view this guideline. We recommend management, controller, sales, finance and insurance, cashiers, and anyone who participates in a cash transaction or files a form 8300 form.

Distribute the Form 8300 Cash Reporting Training

| Title | Duration (Minutes) | Type | Description |

| Form 8300 Cash Reporting | 10 | Course | Upon completion of this course, you will be able to understand and comply with the IRS Form 8300 cash reporting requirements. |

Schedule the activity for distribution

- Click on the Workspaces tab

- Click on the Consumer Finance workspace

- Click on the Money Laundering initiative

- Click on the Form 8300 Cash Reporting Training

- Click on Groups and assign to the appropriate groups, such as management, controller, sales, finance and insurance, cashiers, and anyone who participates in a cash transaction or files a form 8300 form.

- Click on Schedule and set an annual schedule based on the Hire Date. We recommend that you set the Immediate Distribution option to Yes.

- Click Save

Schedule the Cash Reporting Certification Form for Distribution

You are required to complete this certification by January 31 each year to maintain a current and accurate record of compliance with the notification requirement of the Cash Reporting Rules.

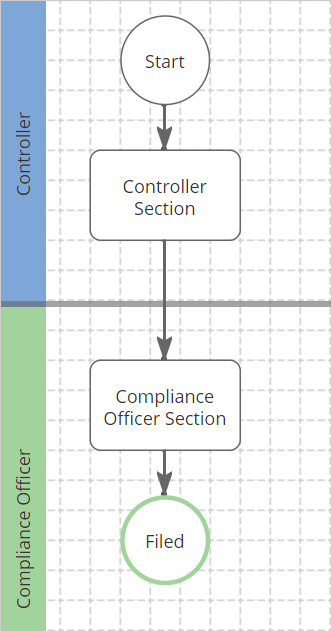

Review the Process Workflow

Set the form routing

- Click on the Admin tab

- Click on Workflow/Forms subtab

- Click on Processes

- Search for and click on Annual Cash Reporting Certification Form

- Edit the routing rules for each stage by following these suggestions:

Stage Suggested Routing Rule Description Controller Section Subject or Queue Route to the "Subject" (i.e. the person to whom the system sent this form), or to a queue that contains your Controller or General Manager, or equivalent. Compliance Officer Section Queue Route to a queue that contains your Compliance Officer.

Schedule the Activity for distribution

- Click on the Workspaces tab

- Click on the Consumer Finance workspace

- Click on the Money Laundering initiative

- Click on the Annual Cash Reporting Certification Form

- Click on Groups and assign to the appropriate group(s), such as your Controller or General Manager

- Click on Schedule and set the appropriate schedule. We suggest an annual schedule due on Jan 31 with a 30 day early distribution window.

- Click Save

Allow Employees to Start the Suspected Misconduct Report Form

Use this form to report conduct you suspect violates the law or ethical business practices. Examples of types of misconduct you may report on this form include document destruction, conflicts of interest, insider trading, money laundering, improper accounting methods, improper overtime practices or other similar inappropriate conduct. No retaliation will result from good faith reports of suspected misconduct.

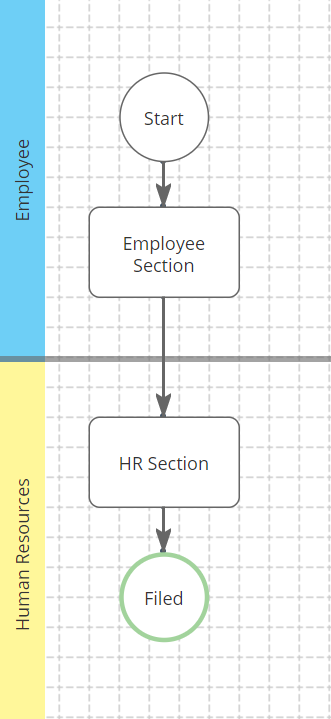

Review the Process Workflow

Set the form routing

- Click on the Admin tab

- Click on Workflow/Forms subtab

- Click on Processes

- Search for and click on Suspected Misconduct Report Form

- Edit the routing rules for each stage by following these suggestions:

Stage Suggested Routing Rule Description Employee Section Creator Route to the "Creator" (i.e. the person who started the form) HR Section Queue Route to a queue that contains your senior Human Resources manager(s) and/or legal counsel, or equivalent.

Set the Activity to be startable by All Employees

- Click on the Workspaces tab

- Click on the Consumer Finance workspace

- Click on the Suspected Misconduct initiative (Note: This form is kept in a separate Initiative because due to its general purpose)

- Click on the Suspected Misconduct Report Form

- Click Edit and set the Start Menu Folder to "Report an Incident" or something similar

- Click Groups and assign "All Employees" (or another set of group as appropriate) within the "In Start Menu" for section.

- Click Save

Comments

0 comments

Please sign in to leave a comment.